War in the Context of Everything Else

The Global Ponzi Scheme

Comments by Harry Freeman: I am an advocate of trade in services from the point of view of organizing private sectors around the world. I am [End Page 455] the head of the Mark Twain Institute, which is a virtual institute with about fifteen consultants on the payroll looking at the future of some economic scenarios.

In 1975 Pan American, which was still there, and American International Group (AIG) took a shot at trade in services. In 1979, I was in New York with the American Express Company and was in charge of strategic planning and acquisitions. We were having problems, which we now call market access problems (we did not have this kind of terminology at that time), in thirty or forty countries. We had no remedy under the trade laws or under the General Agreement on Tariffs and Trade (GATT), which only covered goods.

To make a long story short, we decided that we would have to change that, which meant starting a new round of trade negotiations including services. My boss, Jim Robinson, chief executive officer (CEO) of American Express, asked me to start a new trade round as soon as possible. He asked, "How long will it take?" I said, "I don't know, ten years maybe. I don't know.

I have never done it. I am just reading this book by Ken Dam called the GATT." 1 He said, "Well, do it as soon as you can." I said, "I need some money." He said, "Don't worry about money. This is so important, you will have an unlimited budget." If there was one phrase that really pushed trade and services, that was it. We put a person in Brussels, a person in Tokyo, two or three people in Washington, three people in New York, and so forth.We enlisted the aid, which was really important, of Citicorp and also AIG. John Reed came along a few years later as CEO. We had an alliance in which Jim Robinson of American Express, John Reed, and Hank Greenberg of AIG were working together. I was the go-between.

Having those three men with a lot of staff was the key. We went from zero probability of success to having a chance. We went to the ministerial meeting in 1980, 1982, 1984, and 1986, and the Uruguay Round started. The negotiations lasted an awfully long time. My colleagues in financial services groups and advocacy groups here are calling for a three-year round. They should remember that if the Uruguay Round had ended on time, services would have been dropped.

The round almost collapsed in 1990, and we finally got services in right before 1993, at the end of the Uruguay Round. [End Page 456]...

Another thing that we had to deal with very, very early on is the meaning of financial services. The first thing we did in 1979 was to coin the phrase.

You will not see the term "financial services" before 1979. We did that by asking everybody in the company to talk about financial services particularly with the media, and in about two years the term financial services was part of the lexicon.It is always difficult to determine the meaning of financial services company. What does that mean? Everybody talks about banks, insurance companies, and securities companies, and they are part of it. But what about H&R Block, which is one of the largest accounting firms in the United States and operates in about twenty countries? That is a financial services company, I think. EDS, which does back-office work for American Express Bank, Citibank, and others around the world, also is a financial services company. Credit card processors, such as MBNA, Reuters Information, Standard & Poor's, which operates in 100 countries or something like that, and asset management companies are all financial services companies. That is a partial list. We were quite successful in the Uruguay Round in defining financial services as "any service of a financial nature." This allowed us to have more and more allies, and you have to take care of your allies.

Incidentally, as you read the media and other papers, you always see the phrase "goods and services." That phrase came about in the early 1980s when I wrote at least 1,600 letters. Every time they would say the phrase "goods," I would give the clip to my office manager and say, "Write this reporter, sign my name, and say that he left out the term 'services.

'" And that worked. It was a simple, but laborious, thing to do. Fortunately, those were the days of Wang, so it was not so bad.....

Our argument is that this is good for developing countries. They do not always agree.

They are not so happy sometimes with the American Express offices, or Bank of America, or Chase in their countries. They do not know why they need these foreign banks and foreign financial experts. To us, free competition helps development. They do not always agree. We will win this battle, but it will take many, many years of discussion, scholarly writing, and all kinds of communication.The U.S. private sector on trade in services is probably the most powerful trade lobby, not only in the United States but also in the world.

I would tend to disagree with Sauvé and Gillespie somewhat regarding the amount of work that has been done by our transatlantic partners, particularly the European Union. They only recently formed any kind of organization and pitched in....

You have working relationships, and you see these people, and you see the U.S. Trade Representative and the Treasury Department, and the relationships are good. U.S. government trade negotiators went to Seattle knowing exactly what they wanted in financial services. I do not think that is true in other countries. Sauvé said that we have to deliver the trade negotiators. That is true, but it is not applicable to the United States. We have a fifty-page wish list, and we meet with our trade negotiators as often as weekly.

Corporations as WMD's

There is no greater evidence that the CEO's of the largest corporations are dangerous psychopaths than the sheer audacity of their actions. First, they sell us out - stabbing us in the back with 'Free Trade Fraud: Trade in Services'. Then they ask us to BAIL THEM OUT as our economy is melting down. They expect the American people, who are experiencing record unemployment, record foreclosures, record bankruptcies - the people they tossed out like yesterdays trash, to now pay them - to keep them in business? For what? Their treason? Their betrayal? Their criminality? COME ON! Why aren't we hanging these criminals? Where is law enforcement? Where are the prosecutors? Where is the media? Where are the intellectuals?

Sorry... I lost my head for a minute. I was having a flash back to a time when people knew the meaning of integrity. Today, now that everything is in Full Throttle Reverse, we reward criminals and harass and terrorize law-abiding citizens.

None of what's happening in this country today would be possible without institutional support. The criminal traitors of the "financial services" industries buy their institutional support by providing funding for Think Tanks like the American Enterprise Institute, Cato, Brookings, Manhattan Institute, etc. They start Foundations and they provide funding for non-profit social engineers. These "learned ones" package the corporate agenda to a sellable format. And they provide the "you lie and I'll swear to it' cover for the members of Congress to hide behind.

The Enemy Within

A nation can survive its fools, and even the ambitious. But it cannot survive treason from within. An enemy at the gates is less formidable, for he is known and carries his banner openly. But the traitor moves amongst those within the gate freely, his sly whispers rustling through all the alleys, heard in the very halls of government itself. For the traitor appears not a traitor; he speaks in accents familiar to his victims, and he wears their face and their arguments, he appeals to the baseness that lies deep in the hearts of all men. He rots the soul of a nation, he works secretly and unknown in the night to undermine the pillars of the city, he infects the body politic so that it can no longer resist. A murder is less to fear ~ Cicero Marcus Tullius

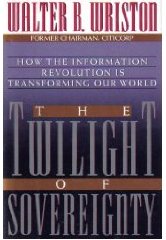

If there was one single person who understood more than

any other, what the internationalization (globalization) of

our financial system would mean to this country, that would be

Walter B. Wriston. Wriston was the CEO of Citibank and

he'd been at the forefront of the Information Age since the

very beginning. In 1992, he wrote a book telling

it to the world. And it's not as if his message went

unnoticed. On the back cover of the book are comments from

Richard Nixon, George Schultz and Henry Kissinger.

The Enemy Within

Left to Right: Paul W. McCracken, Alan Greenspan, President Ronald Reagan, George P. Schultz, and Walter B. Wriston during a meeting of the Economic Policy Advisory Board in the Oval Office, ca. 1981

Walter Wriston

There are a lot of things to know about Wriston, but this small snippet from his New York Times Obituary is noteworthy - especially to those who are interested in the history of banking:

After earning a master's degree from the Fletcher School of International Law and Diplomacy at Tufts University, he immediately joined the State Department as a junior foreign service officer.

He was drafted into the Army, and served 38 months in command of a Signal Corps unit in the Philippines. After he was discharged as a second lieutenant, he decided to look for work in New York City rather than rejoining the State Department.

In June 1946, he reluctantly accepted a job as a junior inspector in the controller's office of First National City Bank. He promised himself he would leave within a year if it was as boring as he expected.

The following are excerpts from Wriston's bio at the Speaker's Platform Speakers Bureau:

During his seventeen year reign as Chairman and CEO of Citicorp/Citibank, Walter Wriston was widely-regarded as the most powerful banker in the world.

Wriston was there at the creation of the modern wired economy, when money began turning itself into bits and bytes and started flowing around the world through satellite transponders and fiber-optic cables. At the time of Wriston's retirement, Citibank had become the world's largest bank, and its investment in computers and software surpassed $1.75 billion.Human intelligence and intellectual resources are now the world's prime capital, Wriston shows. Instant global communication--the marriage of satellites, television, fax, cellular telephones, and most importantly, worldwide computer networks--has had and will continue to have world-shaking consequences. The effect of this revolution, says Wriston, is the formation of a new global democratic order: "No matter what political leaders do or say, the screens will continue to light up, traders will trade, and the currency value will continue to be set, not only by sovereign governments but by global plebiscite," he writes. Today, there can be no more unreported Chernobyl disasters. There can be no more Pearl Harbor-like surprises.

Wriston stresses that in the information revolution, technology itself is of secondary importance. His larger vision is the transformation of our public and private institutions. Within the corporation, too, the twilight of sovereignty is near.

The immediate and simultaneous availability of data to those at every level of authority within the enterprise means that in today's business world, traditional executive power is changing. Looking to the future, Wriston outlines the new management philosophies and radically changed managerial structures that will follow the end of corporate centralization. He is currently at work on his next book, The Quick and the Dead, focusing on new accounting standards for the global economy."

In Walter Wriston's history, you find the power behind the internationalization of U.S. economic policy - and the ideas that are now bringing this country to ruin - both morally and financially. In the preface of his book, "Twilight of Sovereignty" Wriston quotes Baruch Spinoza:

"The last end of the state is not to dominate men, nor restrain them by fear; rather, it is to set free each man from fear, that he may live and act with full security and without injury to himself or his neighbor . . . . The end of the state is really liberty".

Following that quote, Wriston said, "We have learned that freedom is a virus for which there is no antidote, and that virus is spread on the global electronic network to people in the far corners of the world who previously had no hope or knowledge of a better way of life. This process is in train and it cannot be reversed, since the technology on which it is based will not go away."

Because the ideology of Wriston so closely parallels that of the Libertarian Party, I did a search to see if there was any connection. And in fact, there is. For anybody who wants to understand how the Libertarians - whether knowingly or not, actually support the move to "global governance", this article is a must read:

The Enablers of Transnational Progressivism:

Is the nation state threatened?

By John Fonte

Libertarians, of course, oppose the essentially statist-social democratic ideology of transnational progressivism. Nevertheless, some libertarians have contributed to the weakening of the moral argument for sovereign self-government through their constant denigration of the nation-state and thus of democratic politics. The late Citicorp CEO, Walter Wriston's Twilight of Sovereignty was a radical libertarian manifesto that delighted in the rise of transnational action beyond the reach of democratic self-government. The late Robert Bartley, long time editor of the Wall Street Journal, is reputed to have told journalist Peter Brimelow, "the nation-state is finished." And even at meetings of the venerable Mt. Pelerin Society strong arguments were made at one meeting supporting a "world constitution" from a libertarian perspective.

Hostility to the "state" in general (even the limited democratic state) has blurred an understanding of the core principles of liberal democracy. For example, in April 2002 the Cato Institute's Dan Griswold writing in National Review Online objected to new U.S. Border Patrol initiatives against illegal immigration smuggling. He described the border security measures as follows: "It's just another example of government trying to stop people from doing something that is natural to better their conditions."

Mr. Griswold's remarks display confusion about the meaning of self-government. The "people" he refers to are non-American illegal immigrants (in this case many from the Muslim nations of the Middle East) who hire smugglers to enter the United States against the wishes of the overwhelming majority of the American people. The "government" consists of border patrol agents (many of them Americans of Mexican descent) who are clearly carrying out what conservative political thinker Willmoore Kendall in the early days of National Review would have called the "deliberative sense of the American people."

In a similar vein, a Wall Street Journal editorial on July 10, 2006 trumpets the so-called "rights" of illegal immigrants to "contract" with American employers in violation of American law:

"Our own view is that a philosophy of 'free markets and free people' includes flexible labor markets. At a fundamental level, this is a matter of freedom and human dignity. These migrants are freely contracting their labor, which is a basic human right."

This is a rather clear case of a core conflict that should be clarified within the democratic center-right? a conflict that pits the democratic nation-state (the right of a self-governing people to make their own laws concerning immigration, border security, and labor relations) against an alleged international human right to voluntarily enter into employment contracts. Ironically, the arguments of the Wall Street Journal editorial parallel those articulated by many on the left who drafted a recent UNESCO proposal on international migration, which essentially endorses a "human right" of immigration with or without the consent of the people in the host nation.

On a webpage found on the 'Friends of Liberty' website, there is a list of the Directors and Officers of the Council on Foreign Relations. Walter Wriston is listed as being an Officer of the CFR under the Directorship of George Schulz. And by the way, George Schulz's father was a diehard Communist.

George P. Shultz 1980-82

(Reagan's Secretary of State)

William D. Rogers 1980-90

Walter B. Wriston 1981-87

Lewis T. Preston 1981-88

More interesting than that however is the listing for 1934-42

Philip C. Jessup 1934-42

(Supreme Court Justice and probable Soviet spy)

Harold W. Dodds 1935-43

Leon Fraser 1936-45

John H. Williams 1937-64

Lewis W. Douglas 1940-64

Edward Warner 1940-49

Clarence E. Hunter 1942-53

Myron C. Taylor 1943-59

Henry M. Wriston

1943-67

Thomas K. Finletter 1944-67

William A.M. Burden 1945-74

Walter H. Mallory 1945-68

Philip D. Reed 1945-69

Winfield W. Riefler 1945-50

One would be hard pressed to think there was no relationship

between Henry M. and Walter B. Wriston

Libertarians

The Libertarian party was started in Colorado by David Nolan. From the Colorado Libertarian website:

David Nolan and several other friends got together in the summer of 1971 after being disgusted with then president, Richard Nixon announced to the public the implementation of wage and price controls, which basically removed the gold standard and allowed the government to impose inflation easier. Along with the 'illegal' Vietnam War, loss of fiscal conservative direction of the Republican Party and the socialist directions of the Democrat Party, the group started the think tank to come up with a better political solution for real limited government and individual freedom.

Keep in mind that Walter Wriston's book, "Twilight of Sovereignty" was called a Libertarian Manifesto as you read the following written article by William Engdahl:

To avert such a calamity, in August 1971 President Nixon huddled with his closest advisers, among them a US Treasury official named Paul Volcker, then Under-Secretary of the Treasury for International Monetary Affairs, and a long-time associate of David Rockefeller and the Rockefeller family.

Their task was to come up with a solution. Volcker's "solution" to the massive demand to redeem US dollars for gold was to be as simple as it was to prove destructive to world economic health.

Nixon announced to a startled world on August 15, 1971 that from that day, the United States would not longer honor its international treaty obligations under the Bretton Woods Agreement. Nixon had suspended convertibility of the dollar into gold. The New York Fed's Gold Discount Window was locked shut. World currencies went into a free float against an uncertain dollar, a so-called fiat currency. The dollar now was not backed by gold or even silver but only the "full faith and credit" of the US government, a commodity whose marketable value was beginning to be questioned.Debt becomes the vehicle

Soon, with the implicit threat of withdrawing its nuclear shield as its prime persuasion, successive US Administrations realized that rather than depending on its role as the world's creditor as it had until 1971, the American Century could theoretically thrive as the world's greatest debtor, so long as American finance and the dollar dominated world finance.

As long as major US postwar satrapies [6] such as Japan, South Korea or Germany, were forced to depend on the US security umbrella, it was relatively simple to pressure their Treasuries into using their US dollar trade surpluses to buy US government debt. In the process, the US bond or debt markets became far and away the world's largest. Wall Street primary bond dealers were replacing Pittsburg steel and Detroit car manufacture as the "business of America."

To paraphrase the famous quip of former GM president Charles Wilson from the 1950's, the new mantra was, "What's good for Wall Street is good for America." It wasn't. The name financial "industry" even became commonplace, as if to designate money as the legitimate successor to production of real physical wealth in the economy.

Debt - dollar debt - was to be the vehicle for a new role of New York banks, led by David Rockefeller's Chase Manhattan and Walter Wriston's Citibank. Their idea was to extend hundreds of billions of dollars in newly acquired OPEC and other petrodollars, which they "persuaded" Saudi and other OPEC governments to bank their new oil surpluses in London or New York banks. Then those dollar deposits from OPEC, called by Henry Kissinger and others at the time, "petrodollars" went in the form of recycled loans to oil importing and dollar-starved Third World economies. [7]

I'll have to go back and correct what I wrote in "Full

Throttle Reverse" because clearly, the reverse began in 1971

when the decision was made to go off the gold standard and

to base the value of our currency on OPEC oil money but

probably it wasn't noticeable because of the size of our

economy - and maybe because of the proliferation of credit

cards? And where did they get the money to loan

for all those credit cards? Were they using the Saudi

deposits as the banks daily balance to loan money to

Americans? Maybe even loaning it twice?

Once to the third world and once to Americans?

As I've said many times, the financial arena is not my forte but it looks to me like Citibank - under the management of Walter Wriston turned the U.S. financial system into a ponzi scheme. Loaning ever more money in order to pay interest on Saudi CD's. That would explain the race of the multinational corporations to own and control commodities - because they are the only real wealth.

Frontline did a program titled 'Secret History of the Credit Card'. One of the interviews was with Walter Wriston:

"We bought a piece of Carte Blanche in '65 or so, and then the Bank of America started a credit card called Bank Americard, and Citibank started one, and the wonderful name was the Everything Card. It was a regional card. And one day I was invited by a Midwestern bank to come out and talk to their board about whatever the issue was in those days, and walking home that night about midnight, the chairman of the bank said to me, he said, "Citibank's pretty smart, but ... if you're pumping gas in Palo Alto [Calif.] and you see Everything Card, you never heard of it, you'd throw it on the ground." And so he said, "If you want to succeed in the business, you have to have a national name." He was right. The next morning I picked up the phone and called Dick Cooley, who is the chairman of Wells Fargo, and he [had] just started a thing called MasterCard. And I said, "Dick, I want to join." ...

We mailed out 20 million cards across the country. ... I remember going to St. Louis and just about being stoned by the local banker. One of them said to me: "You sent my wife a credit card with a $1,000 credit line. What are you doing in my market?" And I said, "Where is it written that this is your market?" But out of that huge mailing and so forth, the momentum was created that produced what is now Citigroup [and] now has approximately 142 million cards in more than 40 countries. So that's what the early start was like, long before we understood the statistical use, [the use of] statistics for credit losses and all that sort of thing. ...

I found the term Eurodollars relative to money markets started in Europe which is what apparently caused Nixon to close the gold window. I found this article titled, "Greenspan: The Wizard of Bubbleland" by Henry Liu. Following a paragraph on the elimination of Regulation Q, the Savings and Loan debacle, he wrote this:

"A political coalition of converging powerful interests was evident. Virulently high inflation had damaged the financial position of the holders of money, including small savers, created by a period of benign low inflation earlier, so that even progressives felt something has to be done to protect the propertied middle class, the anchor of political democracy by virtue of their opposition to economic democracy. The solution was to export inflation to low-labor-cost economies in newly industrialized countries (NICs) around the world, taming US domestic inflation with outsourcing employment overseas and exorcising the domestic inflation devil in the form of escalating US wages. Neo-liberalism was born with the twin midwives of dollar hegemony and unregulated global financial markets, disguising economic neo-imperialism as market fundamentalism. The debasement of the dollar, dragging down all other currencies, finds expression in the upward surge of commodities and asset prices, which pushes down global wages to keep US inflation low. This pathetic phenomenon is celebrated as economic growth by neo-liberals."

It must be his political bias against the American middle class that prevents him from understanding that this was anything but a protection for the middle class. It was the beginning of economic warfare against the middle class. If you export their jobs, the "propertied middle class" doesn't stay "propertied" for very long. In fact, most "propertied middle class" are just urban sharecropper's in the bank's property - responsible for maintaining the value of the property for the privilege of being called an owner to something they can never own because of property taxes. And how can you have inflation in a debt based economy anyway? It seems to me that what they were really doing was accelerating the squeeze on the middle class to finish them off - to take away all of their assets - with the goal of ultimately reducing them all to penniless peasants.

[Side note: His convoluted thinking is the result - I believe - of the inability to understand "Reverse". He assumes that the U.S. was building wealth. They weren't. They were building debt - and they've done just a bang up job of it. And therein lies the problem of having the Financials Industry driving our economy. The economy is just digits in a computer to them and it doesn't matter which side of the ledger the numbers appear on - they can make money on either side. But the people - who by the sweat of their brow and their raw materials - try to build something tangible, which side of the ledger the numbers appear on means everything.]

Oh well, enough of that. I'm letting my curiosity run away with me. Back to Walter Wriston. In 1996, Wriston did an interview with Wired News titled, "The Future of Money". In that article, he reveals the real plan for money which is to have everybody accept digits in a computer as having value. Of course, the Banksters will set the value of those digits and you will live according to the standard that they deem appropriate for all of you peasants.

Excerpts:

Wriston was there at the creation of the modern wired economy, when money began turning itself into bits and bytes and started flowing around the world through satellite transponders and fiber-optic cables.

Wriston bet the bank on technology during his 17-year reign as chair and CEO of Citicorp/Citibank. Under Wriston, Citibank set out in the 1970s to "wire" its customers into automated, online, checkless, international users of "financial supermarkets" based on CATs and ATMs. This "thin branch" of customers wired into a global network would be the engine of Citibank's financial growth.Wired: What is the future of money?

Wriston:

The revolution that's waiting in the woods is smartcards. They issued 300,000 during the Olympics in Atlanta. It was the first mass use of smartcards in America.

Explain smartcards.

One kind is an electronic purse. It's basically a traveler's check that makes exact change. You give 7-Eleven 50 bucks, and they give you a card that goes in vending machines. When the card is debited down to zero, you throw it away.

The second kind of smartcard is rechargeable. A third kind involves identification. It holds a computer chip with your DNA signature or a digital picture.

This technology is on the verge of exploding, and when it does, people will think of smartcards as money in the same way they now think of traveler's checks as money.

Why switch from greenbacks to smartcards?

The idea of carrying a card with both built-in identification and money has a certain charm, as opposed to carrying a bunch of cash that can get lost or stolen. The card is secure, because it won't work unless you know the personal ID numbers. In France, they introduced smartcards by fiat: they just announced one day that you had to use smartcards for all automatic teller machines. Smartcards are very big in Germany, and in 1995, 400 million smartcards were shipped to Asia. You can't make a phone call in Japan without one. Maybe I'm wrong, but I think money is about to remake itself.

A Virtual World for Real People

In the course of doing the research for my website, one thing that has become crystal clear is that all people - in all the countries of the world have been the victims of the con artists of the financial industry - more accurately, high class thieves empowered by technology. The people in developing countries think that the people in the developed countries are rich - when all they are really is debt slaves. The people in the developed countries see their jobs - which are their lifeline in the debt economy being transferred to the developing countries so that people in the developing world can become debt slaves too.

In the previous section, it

was mentioned that William Brock started a subgroup of the

G8 which they called "The Quad" - Quadrilateral Ministers

Group comprised of trade ministers from Canada, Japan, the

European Union and the United States. This is the group I

would identify as the principals in the global con game of

the financials industry. It becomes clear when you

find that the European people are suffering the same kind of

economic meltdown that the U.S. is facing different only in

the sense of their norms and traditions (i.e. French Dream,

British Dream, German Dream - relative to the American

Dream).

Before going further in to this, I need to take a trip down memory lane to the early part of the decade. I was watching a hearing on C-Span - I'm not sure what committee but I think Senator Grassley was the Chairman. The subject of the hearing was corporate tax fraud. There was an anonymous witness who testified behind a screen because he was afraid for this life. I believe he had been an accountant who had been involved in setting up a tax shelter scheme whereby U.S. corporations were leasing European infrastructure and were writing it off their U.S. income taxes. What that means in effect, is that the U.S. taxpayers were subsidizing the Europeans in their infrastructure costs. This begs the question, 'why would anybody offer a sewer pipe for lease? And - Why would anybody take them up on it? I believe I found the answer in this research on 'Trade in Services'.

The following is an excerpt from an article titled, "Why we need EU Bonds" in the section called, "A Little History":

The principle of borrowing money from financial markets on behalf of the European Community has previously been applied to grant aid to extra-EU countries, in particular before the 2004 enlargement. Kosovo, Moldova and Georgia are all currently receiving financial help through EU loans raised on the market. In January 1993, Italy, a member of the European Community (the EU’s forerunner), was granted an eight billion ECU loan to support its strained balance of payments. Since then, no member state has received financial help through this instrument.

The idea of borrowing money via the issue of EU bonds was first launched by former Commission President Jacques Delors via his 1993 plan for growth, competitiveness and employment. Delors initially wanted EU bonds to fund the European budget. But the majority of member states opposed the idea, fearing it would ultimately increase their expenditure on the Community budget.

Borrowed money has been used by the EU to fund projects in several cases, although the amounts involved have been small. For instance, a ‘New Community Instrumentexternal ‘ was used in the late 70s and early 80s to help regions affected by earthquakes in Italy and Greece. Italy has recently proposed using European bonds to fund key EU projects, but the idea garnered little support...

Jacque Delors White Paper on Growth, Competitiveness and Employment is the European Master Plan for European competitiveness in the 21st Century. Strip off the name 'Delors' and you'll recognize the elements of the plan immediately because it America's Master Plan and no doubt it's Canada and Japan's Master Plan as well.

Page 6 -

Why this White Paper?

"The one and only reason is unemployment. We are aware of it's scale and consequences too. The difficult thing as experience has taught us is knowing how to tackle it.

To summarize what the fraudsters have done is that in swapping debt, they used the deposits from the "loans" to increase the money supply to build infrastructure creating the illusion of prosperity while implementing the 'Global Information Society' that by definition reduces employment opportunities for people. In fact, the design of the 21st century economy according to the Master Plan promises growth by implementing 'smart systems' that by definition exacerbate the unemployment problem. The more automation (control) there is - the less people are required and the less opportunity there is for personal or macro economic growth. They are selling a virtual reality of 'Less is More' while to those of us who live in the real world, 'Less is Less' and a virtual meal is not a replacement for the real thing.

Hopefully, you can also see why the bail out plan for the banks won't work - even if they internationalize the oversight. They are adding debt on debt to achieve growth for an administrative system that is designed to maximize efficiency by controlling the resources to the maximum degree. You can't constrain - and grow at the same time. And debt is not wealth - no matter how many zeros you put behind the number.

Vicky Davis

April 25, 2009

More on the European Debt Swaps:

Debt for

Education Swaps

http://www.un.org/esa/documents/ecosoc/cn17/1996/ecn171996-14a1.htm

Delors

Report

http://www.unesco.org/delors/delors_e.pdf

Unesco -

Debt Swaps for Education

http://unesdoc.unesco.org/images/0015/001537/153714e.pdf

More on

Euro Bonds - debt swaps

http://fistfulofeuros.net/afoe/economics-and-demography/the-eu-bonds-story-rumbles-on/