Regulatory Racketeering

It was in the national public interest that the Public Utility Holding Company Act of 1935 (PUHCA) was passed by Congress. It provided regulatory oversight of utilities to prevent them from fleecing investors and ratepayers through a variety of schemes and scams involving subsidiaries, sham transactions, etc. Public Utilities Commissions were established to provide the oversight called for in the legislation.

|

|

|||

|

|

|

|

|

|

|

|||

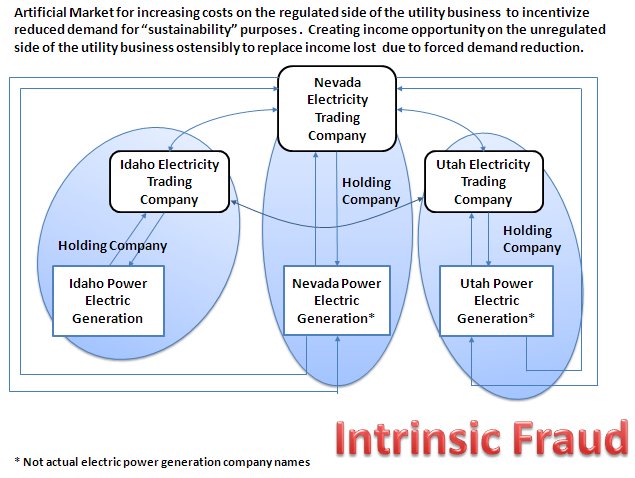

The splitting off of a function of Idaho Power's regulated business into a separate subsidiary that is unregulated with both Idaho Power and the new subsidiary being subsidiaries of IDACORP Holding Company is exactly the situation that the Congress was correcting with the PUHCA of 1935. But this time around, they are doing it with the full knowledge and permission of the supposed regulators, Idaho Public Utilities Commission (IPUC).

With the approval of the Idaho Public Utilities Commission, Idaho Power was setting up to play the Enron computer trading game of "Screw the Customer". Note that the diagram says "ostensibly to replace income lost due to forced demand reduction". The reason for the qualification is that the profits from the utility don't go down despite demand reduction. The price per kilowatt hour keeps going up as the cost to buy the electricity from the artificial market increases.

Electricity Trading Market

Vicky Davis

December 19, 2011