The "Market" Racket

Yesterday, I was reviewing all the documentation I have on energy, public utilities, conservation, etc. as part of project to organize all of them into a coherent portfolio. Naturally when I started this project, I began with Ken Lay and the story of Enron but the story actually begins decades before the Enron meltdown of 2001.

In 1972, Ken Lay was the Deputy Undersecretary of Energy working for the Interior Department Secretary Rogers Morton. Some reading this may remember the "oil crisis" in 1973. The Organization of Petroleum Exporting Countries (OPEC) countries raised the price of oil by 70% and placed an embargo on exports of oil to the United States and other nations allied with Israel. The alleged reason for OPEC's price extortion was because Nixon took us off the gold standard but that doesn't really square with the Israel connection. Regardless, the "oil crisis" event was used as the raison d'être (peak oil so they claimed) for what has become an organized crime wave in the United States predicated upon the principles and concepts espoused in United Nations Agenda 21.

Following the coup d'etat of the Nixon Administration and the treason at Helsinki executed by the appointed replacement, Gerald Ford, the people of the United States elected a peanut farmer from Georgia. Carter was a disaster walking. One has to wonder if his administration wasn't really a national "bread and circuses" event in it's own right. At any rate, in 1978, the Congress passed and Jimmy Carter signed legislation that was really a sweeping overhaul of the nation's laws concerning energy. The National Energy Act of 1978 included the following:

Public Utility Regulatory Policies Act (PURPA)

Energy Tax Act

National Energy Conservation Policy Act (NECPA)

Power Plant and Industrial Fuel Use Act

National Gas Policy Act

Another piece of legislation that Carter signed was a bill that consolidated and reorganized the regulatory authorities over energy and energy resources into a new Department of Energy. With respect for the reason behind the National Energy Act and the creation of the Department of Energy, the main objective of the department was to drive up prices to drive down usage. Pure and Simple. In the natural gas business, the strategy was to create a mess with regulation and then to de-regulate the market. That's where Ken Lay came in as COO of Houston Gas Company. "In 1985, HNG merged with InterNorth to form Enron, and Kenneth L. Lay became chairman and CEO of the combined company the next year."

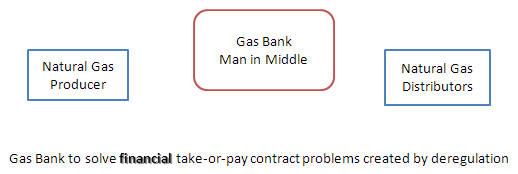

In previous work, 'Where the Bodies are Buried', I documented the strategy that Ken Lay used to build Enron that was the result of the regulatory morass that in hindsight was an attack on both the producers and distributors of natural gas. What Ken Lay did to "solve it", was to propose a middle man strategy which he called a Gas Bank.

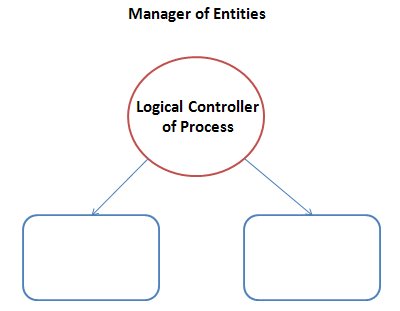

If you strip away the labels and look at the organization

from a process point of view, what you have is the essence of a computer system.

It doesn't matter what the function of the system is; nor does it matter the

physical implementation of it. Computer systems are written to manage the

process and to control the entities by defining how the entities behave -

whether you call them rules, standards, roles, whatever. It doesn't

matter. You can think of the system as the Master Marionette. In

business terms, within a corporation, it's merely controlling the process and

assets of the corporation. In political terms when the government or a

quasi-government entity does it - and the entities are private sector, it is

collectivization.

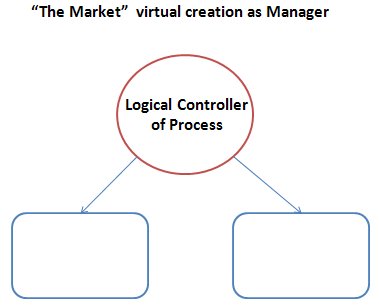

In a country that is being run by organized crime and that

relies on propaganda for deception it's called "The Market".

So why did I go through this little

exercise? It's because this morning as I was refreshing my memory

concerning Enron, Ken Lay and Jeff Skilling, I thought of Gazprom wondered about

them because I've seen them mentioned in the news but I was always busy pursuing

other lines of inquiry. I hit the jackpot. The scandal with Gazprom

parallels the Enron scandal even to the extent that one of the Big Five

accounting firms was involved - auditing and advising.

This is from an article in Bloomberg from 2002 titled, Gazprom: Russia's Enron?:

|

Itera has a USA subsidiary. Their headquarters facility curiously resembles a Las Vegas hotel at first glance. "Oil for food"?

Itera USA is an American branch of the Itera Group of companies. Originally a commodities trading company, Itera USA was created in the wake of the collapse of the Soviet Union, when the previous economic ties between the former Soviet Republics were broken and the new countries, with a total population of over 250 million people, faced enormous difficulties providing the basic human needs such as food and medicine. Multi-national corporations did not rush to do business with these countries because of their insolvency and the inherent political risks. In this dire situation, Itera was founded in 1992, and created a unique network of barter transactions not only with the governments of the new nations, but also with plants, factories and other commercial entities.

Innovation

In 1994 the office of Itera USA, in conjunction with the Itera Group of Companies provided large shipments of produce to Turkmenistan. Based on the initial success in the region, Itera reached an agreement with Turkmenistan forming the first private gas trading company in the Former Soviet Republics. This new entity traded Turkmenistan gas to Ukraine in exchange for barter, which was handled by Itera Group, with headquarters in Moscow.

The mention of one of the "The Stans" - in this case Turkmenistan, made me wonder if the story of James Giffen was connected to this Gazprom-Itera story of accounting fraud, pipelines and tax evasion. I found the story of James Giffen very intriguing but at the time (2005), I didn't have anything that connected it to except a general idea of public corruption involving Russians, Mikhail Gorbachev, San Francisco and the Presidio. (The Russian Connection)

This story is no longer posted on the web, but I was able to retrieve it from the Internet archive:

Kazakhstan: United States vs. James H. Giffen

Other stories I gathered on Giffen include:

United States Attorney - Press Release -

March 31, 2003

Indictment: American businessman charged with $78 million in unlawful

payments

United States Attorney - Press Release -

April 2, 2003

Indictment:

Unlawful payments and tax evasion

United States Attorney - Press Release -

May 3, 2003

Civil Forfeiture

Action - Conditional Release of Funds to Foundation for benefit of poor

children in Khazakhstan

Who is James Giffen?

Recordnet - Stockton, CA - August 31, 2005

You might be asking by now, how is this related to what I wrote at the beginning of this. Here it is in an article by Marlena Telvick posted on Asianet (retrieved from the archive):

|

What a difference a few years and high level connections

make:

2010 - New York Judge: Kazakh bribe defendant is Cold War Hero

Giffen used his expertise to advise Kazakhstan on foreign investments and provided advice on economic development, helping the country develop its vast natural resources, Pauley said.

"In doing so, he advanced the strategic interests of the United States and American businesses in Central Asia," Pauley said. "Throughout this time, he continued to act as a conduit for communications on issues vital to America's national interest in the region."

So Giffen - and corrupt accountants, in

this case, PriceWaterhouse were Reagan's secret weapon against the

Soviet Union. Officially sanctioned corruption through accounting trickery and bribery they managed to

corrupt public officials, divert tax revenues and public money to dummy

companies and through bloated contracting cycle money back into the hands of the

relatives of the corrupt officials. If that doesn't sound familiar, it

should because that's exactly what Enron was doing - except that I don't know if

Enron was putting money into the hands of relatives of public officials but I'd

be willing to bet...

Jumping ahead a little bit, the image of President Nursultan Nazarbaev of Kazakhstan has been sheep-dipped, his corruption wiped from the pages of history and now he's a New World Order success story:

In 2001, Seymour Hersh wrote an article titled, The Price of Oil; What was Mobil up to in Kazakhstan and Russia?

|

The common thread through all of these stories is "the

market" - commodities, front companies, barter deals, money laundering,

unrelated transactions, corruption of public officials, tax evasion.

Oil is a commodity. Natural gas is a commodity. Electricity is a commodity. Enron was an example of a front company for trading energy commodities and if you just do a little reading on the Public Utilities Holding Company Act of 1935 and the reason it was passed in 1935, plus the investigative paper trail of Enron's activities, then you will gain a conceptual understanding of the kind of corruption that "the market" entails. Unfortunately (and disastrously) for us, PUHCA was repealed in 2005 in legislation sponsored by Senator Pete Dominici of New Mexico and now the "peak oil" scamsters of the Department of Energy "partnered" with the Technocrats of the technology industry are running the electricity "market" through the implementation of the smart grid. In plain language, the commodity trading criminals have institutionalized the corruption within our state and federal governments. They masquerade as regulators while they set up the components of "the market" for fraud and extortion. Case in point, Senator Joe Lieberman was the lead on the investigation into the Enron scams. Senator Joe Lieberman was the Senate representative for Al Gore's "reinvention of government". And Senator Joe Lieberman was involved in writing the legislation to "fix" the problem of Enron's fraud - and now we have no electricity market regulators - only advisors.

When you go to the Department of Energy website, do you see anything that looks like government?

In the 2009 National Broadband Plan, a company called EnerNOC was mentioned as a "virtual power company". Enron was a "virtual power company". The way it is described, the "cycle slicing" of kilowatts by EnerNOC will be voluntary. But there is nothing that says it has to stay voluntary. The Smart Grid and Smart Meters will allow them to control electric usage - having you live under their rules and demands.

They've broken up the utility business model of generation to end user service inserting the middle man as a "virtual power company" supposedly on the idea of competition. There is no competition. The "competition" is a virtual farce. There is one product and the product doesn't vary and there is nothing that anybody can do to enhance the service beyond its purpose which is to electrify. That's it. A stream of electricity is a stream of electricity - period. No substitutes. No variability.

Multi-party bartering. Here is where the difficulty comes in for criminal investigations. Unrelated transactions are difficult - almost impossible to trace back to the source deal - especially with the assistance of computers. And adding to the difficulty, with a trading platform like...say, Pierre Omidyar's eBay with the capability of symbolic replacement and the wizard behind the curtain with the records - but not necessarily all the records, it would take years to resolve one line of inquiry on one case.

We have systemic corruption in the essential critical economic sector of the country - electricity - energy. The only way to deal with this kind of problem is very strict laws, severe penalties that are enforced and essentially closed borders until the "actors" in the crime wave are expunged from the system. Simply stated, if you have a cockroach problem, you don't solve the problem by killing one cockroach at a time. You have to tent the structure and fumigate - and we need it NOW.

Vicky Davis

April 2, 2014

P.S. To Whom It May Concern:

No... I did not miss the symbolism you rotten **************