(a) Establishment

The Secretary shall establish a regional innovation program to encourage and support the development of regional innovation strategies, including regional innovation clusters and science and research parks.

From Ivy League Policy Rackets to Treason to Crimes Against Humanity

In the course of my research, one thing has become very clear.

Nearly everything I write about can be traced back to a few universities with

Harvard being at the top of the list in terms of frequency of reference. There is a very good reason for so many threads of my research

to tie back to Harvard. In 1989 following the failed election campaign of

Michael Dukakis, the New York Times published an

article written by J. Anthony Lukas, about Harvard's Kennedy School of

Government - "the temple of technocracy on the Charles".

IRONICALLY, THE school's distinctive approach to government had its flowering in the Kennedy Administration, specifically in that bundle of techniques, sometimes called ''cost-benefit analysis'' or ''systems analysis,'' developed by the Rand Corporation, then elaborated by the ''whiz kids'' in the Defense Department under Robert S. McNamara. If statistics, econometrics and microeconomics failed to carry the day in Vietnam, they were the bedrock of the ''program planning and budgeting'' process used to chart the major initiatives of the Great Society, such as the poverty program and subsidized housing.

Lukas' article is important because he describes the evolution of thinking at KSG concerning the underlying philosophy for students of public administration. Government and the management thereof, is a public trust. Harvard students and faculty have turned government into a private trough for their graduates and friends to feed from.

Concerning the KSG students of public administration:

"Moreover, these young entrepreneurs needed a discipline that promised a payoff in the real world, comparable -in power and influence, if not in salary - to the rewards of law, medical and business degrees. Now, with a couple of years of systems analysis under their belt, graduates could bypass the boring green-eyeshade world of public administration and the grubby notion of running for elective office, catapulting themselves into the glitzy realm of ''policy making'' in big-time bureaucracies such as the Office of Management and Budget and the Energy Department."

One need only look at the size of Harvard's endowment to know how well the students of Harvard do at the game of insider policy.

Harvard Endowment Rises 21% on Hedge Fund Gains

Bloomberg News

September 22, 2011Harvard University, the world’s richest school, said its investments rose 21 percent in the past year, outperforming benchmarks and extending the rebound from record losses in 2008.

The value of the university’s endowment climbed $4.4 billion to $32 billion as of June 30, according to a report yesterday by Harvard Management Co., which oversees the fund. The increase in value also reflects gifts from donors and distributions to help finance operations at the Cambridge, Massachusetts, university.

Jane Mendillo, who took over as chief executive officer of Harvard Management in July 2008, plans to shift more money in- house as she continues to cut the endowment’s use of outside asset managers. She has overseen the fund’s rebound from a 27 percent loss in the wake of Lehman Brothers Holdings, Inc. (LEHMQ)'s collapse in September 2008...

‘Policy Portfolio’

Harvard Management, which is based in Boston, measures its performance against a theoretical “policy portfolio” that it says reflects the most appropriate mix of assets for the university. The endowment beat the 20 percent gain by the benchmark in the past year, as well as the 19.5 percent increase of a hypothetical portfolio of 60 percent stocks and 40 percent bonds. Harvard’s fund returned 5.5 percent, 9.4 percent and 13 percent in the past 5, 10 and 20 years, topping the policy portfolio, the report said.

The ultimate in insider trading is to design and write government policy, use the institutes of the university to bring the marks into the game and then exploit the policy and rob the people. It's quite a racket they have going on.

Lehman Brothers held the biggest portfolio of Collateralized Debt Obligations (CDOs) and the Harvard endowment lost money on them, but they made the $4 billion back in three years. My guess would be that the endowment had bets placed against the CDOs on a longer time horizon.

According to most articles, Goldman Sachs was the largest seller of CDOs. There is a good reason for that. Robert Rubin, worked for Goldman Sachs before becoming Treasury Secretary for the Clinton Administration and he helped to secure passage of the legislation that set up the entire 'Community Reinvestment' fraud scheme.

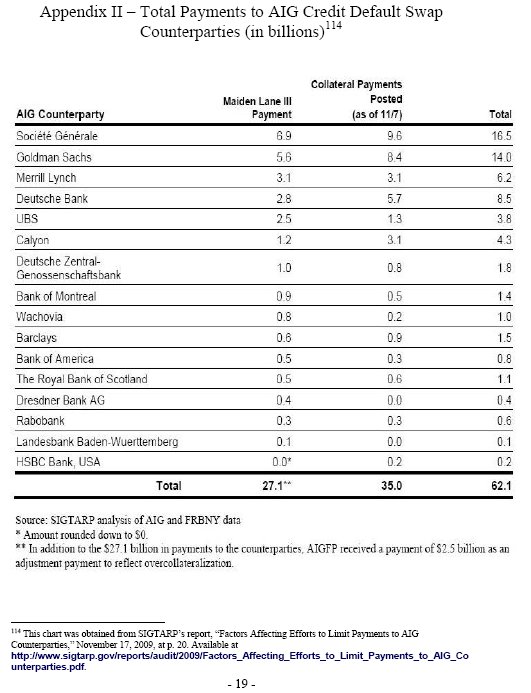

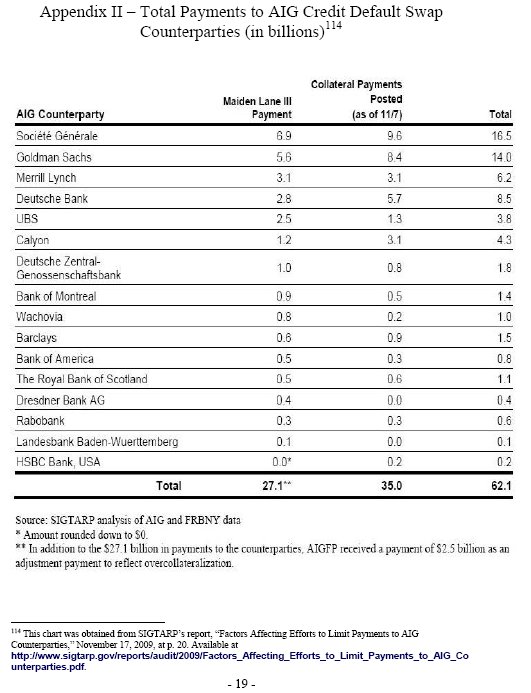

AIG was left

holding the bag because they provided default insurance so they were insuring

the garbage that Goldman's underwrote. The following is a

chart from a report produced by the House Committee on Government Oversight

and Reform. Notice that the biggest percentage of insurance was held

by foreign banks. The

New York Federal Reserve Bank fought for two years to keep this information

from the public.

The Proverbial Gun to the Head

Seeing SOCIETE GENERALE at the top of the list brings to mind, the Houston Summit, 1990, G7, Paris Club - Houston Terms. One of the very interesting websites that I found while looking at this French Bank that profited so much from our meltdown is this one - with a chart from SOC GEN. He didn't quite know how to interpret the chart except that it's clear there is only one path - and that's investing in "Green" - with green being UN Agenda 21 green.

George H. W. Bush

gave them the gun. Bill Clinton loaded it. And when the

condition were right, they pointed it at us and George W. Bush knuckled under

and we are now living under the tyranny that they all brought to us.

It turns out that the CDOs weren't just for subprime mortgages as we were all led to believe by media coverage. I watched pretty closely but never heard or saw a reference to a 'Multi-Sector CDO' until I started my current project which is to profile the people I consider to be most responsible for the condition of our country the relevance of which will be clear in a minute.

The following is a description of Multi-Sector CDOs from Wikinvest:

Multi-Sector CDOs

Multi-sector CDOs are transactions that include a variety of structured finance asset classes in their collateral pools. As of March 31, 2009, $27.4 billion, or approximately 12%, of MBIA Corp.’s total insured net par outstanding of $224.8 billion comprised multi-sector CDOs. Additionally, as of March 31, 2009, 23% of MBIA Corp.’s $122.9 billion CDO and related instruments portfolio insured net par outstanding comprised multi-sector CDOs. The collateral in the multi-sector CDOs includes subprime RMBS and other RMBS, CDOs of ABS (multi-sector CDOs), Corporate CDOs, Collateralized Loan Obligations (“CLOs”), other ABS (e.g. securitizations of auto receivables, credit cards, etc.), Commercial Real Estate CDOs, CMBS, and Corporate credits.

Moody's - September 15, 2000, Approach to Rating Multi-Sector CDOs

The way I knew about Goldman Sachs activities in 'Community Reinvestment' was

because of research that I did concerning corruption of the Mayor of Boise ID,

the corrupt regional partnership of mayors of the surrounding towns facilitated

by a grant from Federal Highway Administration to "develop a regional

approach to growth issues and preservation of our quality of life".

And all of that was discovered because of an unexplained and unwarranted

construction boom in Star, ID.

My original research can be seen HERE. When I realized that the economic meltdown had something to do with Community Reinvestment, I tracked down all of the original links on Community Reinvestment I could find and placed them on this page of recovered links. The one to look at in particular is the Community Revitalization Fund and Goldman Sachs. On page 4, you'll see reference to all of the program areas that were funded under the heading of 'community development'.

So what they were doing was a "holistic" remake of communities with strategic plans and grants provided by HUD, the Federal Transportation Department, the Economic Development Administration and the Environmental Protection Agency. The EPA's involvement was through a supposedly private sector network called the Smart Growth Network - which had a European counterpart by the same name. One of the main objectives was regionalization - the partnership of mayors in different cities across county lines.

In short, the idea smart growth-smart community was to build a global 21st century hub city although, it was never presented in exactly those terms but what happens is that all of the money that flows into a community creates a false economic boom. Lots of debt is created that can't be repaid once the "hot money" leaves. This was a pattern that I saw replicated many times over - not just in this country, but in other countries. One element of the pattern was that it was foreign banks providing a big percentage of the money. Recall that in the Cyprus meltdown, it was German banks that were on the hook. And for the meltdown in Ireland, it must have been European banks but might have included American banks also. Of course Ireland is so small that their meltdown wouldn't have even made a ripple for American banks involved.

It was the observation of foreign investment, combined with the false economic boom, combined with the strategy of the "smart community" from a strategic plan for a "designed economy", that led me to the conclusion that what was taking place was what I called a "criss-cross, double cross". The people in the target country are double crossed by their own governments and the criss-cross part of it is because it is foreign investment that drives it - with the foreign investment being for debt creation.

The elements of the "smart community" are what I called Trojan Triangles because I could see that it was a multi-tiered, multi-element construct that was being replicated around the country. The elements include rebuilding infrastructure, regionalization, connections with the universities as the drivers of the economy, the establishment of telecommunications and implementation of the smart grid - including not only the electric grid, but also the water and wastewater systems. It includes the 'small business incubators', social entrepreneurs and the implementation of international land use, building and energy codes - all of which are component parts of the United Nations Agenda 21.

The way this ties into the financial crisis is through the Collateralized Debt Obligations - more specifically, the multi-sector Collateralized Debt Obligations. The multi-sector CDOs have to be the financing mechanism for the hot money and the all out assault on our communities to create debt that can't be repaid because the economic boom is an economic hologram - an illusion.

Department of Commerce

We have to back track for a minute to look at how central economic planning was implemented in the United States. From the minute Bill Clinton and Al Gore took office, their objective was "automation nation". Clinton and Gore both were "New Democrats" - a splinter group that took over the Democratic party with a technology agenda. On March 3, 1993, Clinton kicked off the National Performance Review which was later renamed the National Partnership for Reinventing Government.

Elaine Kamarck, a Harvard professor headed up the National Performance Review. A report by the same name was produced. The following is from Appendix A of that report.

DOC07 Provide EDA Public Works Loan Guarantees for Infrastructure Assistance

This recommendation would provide the Economic Development Administration with authority to use part of its funding as a reserve for loan guarantees for various public economic development projects.

A search on the terms, 'EDA' and 'Public Works Loan Guarantees' brought up a budget report on the Department of Commerce website:

Economic Development Administration

This report describes the elements of the Trojan Triangles pretty much as I saw them it discusses the "investment strategy" - public and private. The following paragraphs are excerpts - not necessarily in the same order as in the report. Highlights added:

The Economic Development Administration (EDA) focuses on accelerating the transition to the 21st Century economy by supporting sustainable job growth and regional competitiveness across the United States through the promotion of the Jobs and Innovation Partnership. At its core, the Jobs and Innovation Partnership puts a premium on regional innovation cluster strategies as the platform for linking, aligning, and organizing multiple initiatives across the Administration and across the nation’s economically integrated metropolitan and rural areas. EDA’s Jobs and Innovation Partnership agenda reflects the reality that American communities and businesses must embrace the global economy and re-tool to develop the 21st century infrastructure, technology, exportable products and services, and international markets needed to compete.

In FY 2012, EDA will expand its efforts to foster globally competitive regions through its new Regional Innovation Program. This program will be specifically targeted to support Growth Zones, a collaborative, multi-agency effort to stimulate regional economic development. Additionally, EDA will utilize its 21st Century Infrastructure Program (successor to Public Works) to support a new loan guarantee program which authorizes EDA to guarantee up to 80 percent of the amount of a loan provided that the maturity date does not exceed the lesser of 30 years or 90 percent of the useful life of any physical asset financed by the loan. EDA will utilize $7,000,000 in 21st Century Infrastructure Program funds for the subsidy cost (as defined in section 502(5) of the Federal Credit Reform Act of 1990), to remain available until expended.

EDA will continue to leverage the potential of institutions of higher education to promote economic development. EDA’s Office of Innovation and Entrepreneurship has led the federal government’s effort to build stronger mechanisms for commercializing research at our universities. And, EDA’s University Center program can play an important role in this effort as well; therefore, EDA is proposing to increase investments in university-based economic development investments as part of its FY 2012 budget.

Clusters, including science and research parks, broadband/smartgrid technology, business incubators and accelerators, high-tech shipping and logistics facilities, and workforce training centers. For example, the Virginia Tech University Institute for Advanced Learning and Research in Danville established a branch of the University in a very rural area near the North Carolina border. The regional economic impact of this science park may be felt well beyond the state line as it focuses on research in fields of study such as nanotechnology and polymer science and draws companies to the area that want to be close to access this expertise. EDA utilizes its many programs, including its University Center, Partnership Planning (Successor to Planning), and 21st Century Innovation Infrastructure programs, to strengthen the unique regional assets that support and drive cluster development and economic prosperity across the nation.

EDA will continue to provide strategic investments that provide technical assistance for the University Centers; planning support for EDA’s network of Economic Development Districts and for Native American Indian Tribes; resources to help distressed communities revitalize, expand, and upgrade their hard and soft infrastructure through the 21st Century Innovation Infrastructure, the Economic Adjustment Assistance, and the Sustainable Economic Development (Successor to Global Climate Change Mitigation Incentive Fund) Programs; and investments to foster cutting-edge tools and data

through the Research and Evaluation program.

The reason the Regional Innovation Program is highlighted in red is because

there is a section in

U.S. law 15 USC § 3722 that defines it.

(a) Establishment

The Secretary shall establish a regional innovation program to encourage and support the development of regional innovation strategies, including regional innovation clusters and science and research parks.

(b) Cluster grants

(1) In general

As part of the program established under subsection (a), the Secretary may award grants on a competitive basis to eligible recipients for activities relating to the formation and development of regional innovation clusters.

(2) Permissible activities

Grants awarded under this subsection may be used for activities determined appropriate by the Secretary, including the following:

(A) Feasibility studies.

(B) Planning activities.

(C) Technical assistance.

(D) Developing or strengthening communication and collaboration between and among participants of a regional innovation cluster.

(E) Attracting additional participants to a regional innovation cluster.

(F) Facilitating market development of products and services developed by a regional innovation cluster, including through demonstration, deployment, technology transfer, and commercialization activities.

(G) Developing relationships between a regional innovation cluster and entities or clusters in other regions.

(H) Interacting with the public and State and local governments to meet the goals of the cluster.

Skipping down to (d)

(d) Loan guarantees for science park infrastructure

(1) In general

Subject to paragraph (2), the Secretary may guarantee up to 80 percent of the loan amount for projects for the construction or expansion, including renovation and modernization, of science park infrastructure.

(2) Limitations on guarantee amounts

The maximum amount of loan principal guaranteed under this subsection may not exceed—

(A) $50,000,000 with respect to any single project; and

(B) $300,000,000 with respect to all projects.

(3) Selection of guarantee recipients

The Secretary shall select recipients of loan guarantees under this subsection based upon the ability of the recipient to collateralize the loan amount through bonds, equity, property, and such other things of values as the Secretary shall deem necessary. Recipients of grants under subsection (c) are not eligible for a loan guarantee during the period of the grant. To the extent that the Secretary determines it to be feasible, the Secretary may select recipients of guarantee assistance in accord with a competitive process that takes into account the factors set out in subsection (c)(3)(C) of this section.

The "science park" development in Idaho that I dubbed a Trojan Triangle is called "The CORE". One of the local hospitals is the anchor business for it. Most of my early research on it centered around the fact that Governor Butch Otter was marketing the location to the Communist Chinese. But after that research was done, then I focused on the nature of the park itself. What they were building was a "health sciences/technology" park. Idaho has a School of Pharmacy at Idaho State University in Pocatello, Idaho and the location in Meridian, Idaho is an extension campus of Idaho State.

As I was doing this research, I noticed not only that the Trojan Triangle plan was being replicated all over the country, but also that medical research facilities were being built and/or greatly expanded. The connection was obvious enough for me to have written:

The Trojan Triangle - 21st Century Manhattan Project

How do I know I was right? Because of the replication - globally. The following aren't the only evidence I have. They are just the most recent links.

Sweden - Food Valley - Milk and Genomics

Planning for Regional Innovation Clusters - Presentation by the American Planning Association

** Note: the speaker in this video notes the fact that biotech parks were big in the 1990's but weren't too successful. The reason is because they needed the health care "reforms" that are just now coming online - the nationalized medical records, telemedicine, Project Destiny (i.e. pharmacists as frontline health care providers), and the replacement of doctors with Nurse Practitioners and Physician's Assistants with computer-aided decision support systems, etc.

So there you have it - the lay of the land so to speak.

From government policy racketeering and central planning, to the treason of the G7 cabal to the coming

crimes against humanity through applied genetics research at the "regional

innovation clusters" for biomedical research.

Vicky Davis

November 16, 2013