In 1918 the Carnegie Foundation established Teachers Insurance and Annuity Association (TIAA), a fully-funded system of pensions for professors. Funding was provided by a combination of grants from the foundation and Carnegie Corporation of New York — including an initial gift of $1 million — and ongoing contributions from participating institutions and individuals. Incorporated as a life insurance company in the state of New York, TIAA began operation under the leadership of Henry S. Pritchett, a former president of the Massachusetts Institute of Technology. By the end of its first year, 30 public and private institutions had signed on.

White Collar War

Did anybody notice that John Chambers, the S&P Analyst who downgraded U.S. debt has a wee bit of an Irish accent? He’s had voice training and his pronunciations are very good, but the ‘tells’ are there. So what is that supposed to mean? I don’t know… it could mean that the Standard & Poors Rating Service is an Irish or UK owned company – like Goldman Sachs, which is headquartered in the UK. It used to be an American corporation – but they aren’t and haven’t been for a long time. But then again, S&P could still be American and could just be giving their honest appraisal of the American future. If I were giving a rating, it would be a D3 – for Dire, Dismal and Dreadful. Regardless, the fact of the “tell” is registered in the Davis memory banks, in the anomalies category and it will stay there until resolved.

The idea that Standard & Poors could be foreign owned didn’t just come to me out of the blue. It was due to retrieval of another anomaly from the Davis memory banks. A few years back, one of my research projects was to find out why an Affordable Housing development was being built in Star, ID. Star is a small rural farm community outside of Boise, ID and was a very unlikely location for a large development – first because there was no market for the homes, second, Boise was losing jobs due to outsourcing, and third, because it wasn’t close enough to the highway to be convenient to travel to where the jobs are located – either in Meridian or Boise. It was an anomaly.

New info... just

in...

US rating downgrade: Jharkhand boy shakes the world

A company named Avimor built the homes. The parent company of Avimor was SunCor, an Arizona Corporation. SunCor, formerly named Energy Development Corporation (name change 1986), was a wholly owned subsidiary of Pinnacle West Capital, a publically traded company (PNW). Pinnacle West Capital was also the holding company for Arizona Public Service, Arizona’s largest electric utility.

Source: Recovered SunCor webpage from 2006

|

|

|||

|

|

|

|

|

|

|

|||

ESG Factors? A rating based on environmental, social factors and governance factors?

MSCI is an ESG Research / Ratings company:

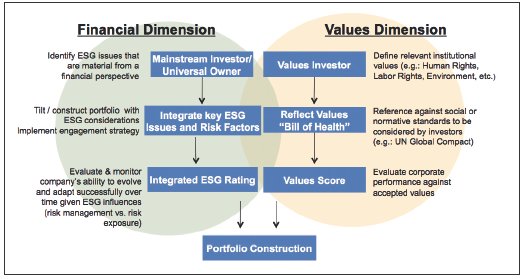

"MSCI offers a wide range of ESG products and services, backed by a global team of analysts and researchers, to support the investment processes of a wide array of institutional investors including pension funds, asset managers and hedge funds. The MSCI ESG Research products and services are designed to address both the financial and the values dimensions of ESG investment strategies ESG Research."

![]()

Norms-Based Screening and Controversy Alerts

• Identifies violations of global norms and conventions and rates

severity of violation

• Evaluates performance and strategy across to four themes:– human rights

– labor rights

– environmental issues

– corruption• Provides an overall assessment of corporate ESG compliance

• Provides ratings and assessment of strategy, as well as systems to manage sector specific risks, ESG impacts, and to avoid violations

• Background information on violations, strategy, and systems

• Coverage: 2,000+ global companies

• Custom screening availableCompliance Screening

• New flexible interface for online screening with portfolio upload capabilities

– Products: Tobacco, Weapons, Gambling

– Countries: Burma, Sudan, Iran

– Issues: Animal Testing, Stem Cell

– Sustainability: Environment, Human Rights, Employee Safety, Discrimination

– Standard Packages – including SRI, Catholic Values• Uses MSCI’s securities database

• Data feeds and flexible delivery formats are easily integrated into client

trading and compliance systems

Who is Innovest Strategic Advisors? From the same 2006 SunCor Press Release:

|

|

||||

|

|

|

|

||

|

|

||||

A 2007 Innovest report was located in a subsequent search. The following are excerpts from the “Innovest Strategic Value Advisors & the United Nations Principles for Responsible Investment”.

UNPRI & Innovest’s Services

By providing institutional investors with

enhanced research on environmental, social and corporate governance (ESG)

issues, Innovest is helping PRI signatories fulfil their commitments to

the Principles in a variety of ways. Whether signatories are interested

in company ratings and quantitative ESG data, or engagement and advisory

services,

Innovest’s Products and Services are flexibly packaged and designed to

meet investors’ needs.

Specifically, Innovest’s

‘i-Ratings’

is our client web portal where the following

Innovest products and services can be accessed:

» Intangible Value

Assessment (IVA) ratings and Company Profiles on over 2,000 companies.

» UN Global Compact Plus screening and assessment service on companies

in the global MSCI index.

» Innovest Activities Screening – negative screening service

» Innovest Strategic Engagement and Advisory Services (ISEAS).

» Regular News Updates (Weekly Stock Monitor and monthly Client Delivery

Newsletter).

» Sector Reviews and Reports on over 60 industries.

» Thematic reports - eg Carbon Disclosure Project.

» Innovest’s Carbon Finance and Clean Technology Practice including our

Carbon Beta Platform and Carbon Portfolio Value Audits.

» Innovest Data Suite and asset management sub advisory services

Innovest’s

Intangible Value Assessment (IVA) ratings

are focused on the nontraditional factors which contribute most heavily

to financial out-performance. Specifically, our ratings evaluate

more 2,000 companies on 120 different performance metrics that fall

under the following four pillars:

» Stakeholder Capital

» Strategic Governance

» Human Capital

» Environmental Management

Another search, and another hit. It's Banki and Wolf - and it's me you hear howling at the Moon.

"An investor initiative in partnership with UNEP Finance Initiative and the UN Global Compact"

One final piece to this chapter in the White Collar War... from the TIAA-CREF History Page:

TIAA-CREF

...

TIAA’s pensions were meant to last a lifetime, and with lives lasting longer and the dollar shrinking, new strategies were needed. TIAA responded by creating the College Retirement Equities Fund, the world’s first variable annuity, which began operation on July 1, 1952. Later that year, an editor at Fortune wrote to a colleague: "I think this is the biggest development in the insurance-investment business since the passage of the Social Security Act."

With consideration for all of the above, it makes the Trojan Triangles of the university-led economic development system as exemplified by "The CORE" more understandable. All my instincts tell me that the "illuminated ones" are once again attempting to solidify power to put the masses in the yoke of control for eternal servitude...

Vicky Davis

August 7, 2011